Key strategies for effective risk management

Managing risk is essential to long-term success, and one of the most powerful tools available to traders for controlling risk is the stop loss and take profit orders. These two types of orders are critical components of a sound risk management strategy, enabling traders to lock in profits and limit potential losses. Understanding how to effectively set stop loss and take profit levels can greatly enhance your trading performance and help you maintain a disciplined approach.

What is a Stop Loss order?

A stop-loss order is an automatic instruction to close a trade once the price reaches a certain level, limiting the loss on a position. This level is set below the entry price for a buy position and above the entry price for a sell position. The goal of a stop loss is to protect your capital from unexpected market movements and to avoid emotional decision-making during volatile conditions.

For example, if you enter a buy position at $100, you might set a stop loss at $95, meaning the position will be automatically closed if the price falls to $95, limiting your loss to $5 per share.

What is a Take Profit order?

A take-profit order is the opposite of a stop loss. It is an automatic instruction to close a trade once the price reaches a specified level of profit. This allows traders to lock in profits before the market can reverse direction. A take-profit order helps traders exit positions at a predefined price, ensuring they capture gains without waiting too long and risking a reversal.

For example, if you enter a buy position at $100, you might set a take profit at $110. This means your position will be automatically closed once the price reaches $110, securing your $10 profit per share.

Why are Stop Loss and Take Profit orders important?

-

Risk Management: Stop loss orders help protect your capital by limiting potential losses if the market moves against your position. Without stop-loss orders, you may face larger-than-expected losses, especially in volatile markets.

-

Profit Lock-In: Take profit orders help secure gains by ensuring that you exit a trade when the market reaches your desired profit level, preventing you from holding on too long and potentially losing your profits due to a market reversal.

-

Eliminating Emotional Trading: Setting stop loss and take profit orders removes emotion from trading. Traders are often tempted to let a losing position ride in the hope that the market will turn in their favor or to delay taking profits, hoping for further gains. These automatic orders help keep your emotions in check and allow for a more disciplined, systematic approach.

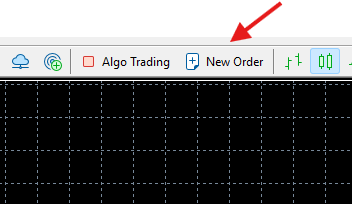

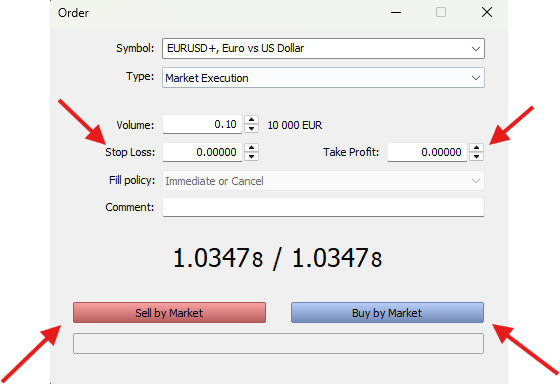

How to set Stop Loss and Take Profit levels

-

Determine Your Risk Tolerance: Before setting your stop loss, decide how much of your capital you are willing to risk on each trade. A common rule of thumb is to risk no more than 1-2% of your account balance per trade.

-

Use Technical Analysis: Many traders use technical analysis to determine optimal stop loss and take profit levels. Key support and resistance levels, trendlines, and moving averages can help identify areas where price reversals are likely to occur. Placing your stop loss just below a support level or above a resistance level can help minimize the risk of getting stopped out too early.

-

Risk-to-Reward Ratio: It’s essential to set your stop loss and take profit orders with a favorable risk-to-reward ratio. A typical recommendation is to aim for a ratio of 1:2 or higher. This means that for every dollar you risk, you should aim to make at least two dollars in profit. By doing this, even if you have more losing trades than winning ones, you can still be profitable in the long run.

-

Account for Volatility: In highly volatile markets, it’s important to adjust your stop loss and take profit levels accordingly. A tight stop loss in a volatile market may result in being stopped out prematurely, while a wider stop loss may give the trade more room to move. Consider the asset's volatility and adjust your levels to ensure they align with market conditions.

Tips for effective Stop Loss and Take Profit strategies

-

Don’t Set Stop Losses Too Tight: Setting your stop loss too close to your entry point can result in getting stopped out frequently due to minor price fluctuations. Give your trades enough room to breathe without excessive risk.

-

Use Trailing Stops: A trailing stop is a type of stop loss order that moves with the market. As the price moves in your favor, the trailing stop adjusts, locking in profits while still giving the trade room to grow. This is particularly useful in trending markets, as it allows you to capture profits without having to constantly monitor your positions.

-

Review and Adjust: Market conditions change, and so should your stop loss and take profit levels. Be prepared to review and adjust these levels as necessary based on new information, price action, or changing volatility.

Setting effective stop loss and take profit levels is a key part of a well-rounded risk management strategy. These orders allow traders to protect their capital, lock in profits, and remove emotions from their trading decisions. By using a combination of technical analysis, risk-to-reward ratios, and a clear understanding of market volatility, you can optimize your trading strategy and improve your chances of success.

|

Need more details? Our support team is always here to help.

Open an account with Eurotrader today!