Hedging in trading is a risk management strategy used to minimize potential losses by opening offsetting positions. This means a trader takes a second position that moves in the opposite direction of their primary trade, reducing exposure to market fluctuations.

For example, in forex trading, a trader might open a buy (long) position on EUR/USD while simultaneously opening a sell (short) position on the same pair. This way, if the market moves against one trade, the other can help balance the loss.

Hedging can be done using different instruments, such as currency pairs, options, and futures, and is commonly used to protect against volatility and uncertain market conditions.

Margin Requirements on Hedges:

In many cases, brokers calculate margin requirements on hedged positions as the sum of the margin for both positions, but some brokers may allow for margin relief or offsetting between the positions (i.e., they might calculate the margin for the net exposure instead of both positions).

Let’s break down the steps involved in calculating the margin requirements for hedged positions.

1. Standard Margin Calculation for Each Position:

The general formula for calculating the margin for a single position is:

Margin= Lot size * Market Price ÷ Leverage

Where:

- Lot Size = Volume * Contract Size (the number of units being traded).

- Market Price: The current price at which the instrument is being traded.

- Leverage: The leverage ratio offered by your broker (e.g., 1:100, 1:500, 1:1000).

2. Calculate Margin for Both Positions (Hedge Case):

For hedged positions, you need to calculate the margin requirements for both the long and short positions separately.

Let’s assume you're opening a long position and a short position in the same currency pair (for example, EUR/USD).

Example: Hedged Position Calculation

Assumptions:

🔹Position 1: Long position on EUR/USD

Trade Size: 1 standard lot (100,000 units of EUR)

Market Price: 1.1000

Leverage: 100:1

🔹Position 2: Short position on EUR/USD

Trade Size: 1 standard lot (100,000 units of EUR)

Market Price: 1.1000

Leverage: 100:1

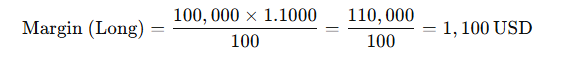

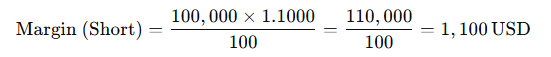

Margin for the Long Position:

Margin for the Short Position:

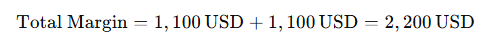

Total Margin Requirement (Without Offsetting):

If your broker does not provide margin relief for the hedge, the margin requirement for both positions would be the sum of both margin requirements:

Thus, the margin requirement for the hedged positions would be $2,200.

Leverage at Eurotrader & Its Impact on Margin

At Eurotrader, we offer high leverage options, which can significantly reduce the margin required for a trade:

🔹Up to 1:500 leverage for global clients.

🔹Up to 1:30 leverage for European retail clients, in compliance with regulatory guidelines.

🔹Professional clients in Europe can apply for increased leverage, up to 1:500, allowing for lower margin requirements.

To simplify margin calculation, you can use Eurotrader's all-in-one trading calculator, available on our website.

Need more details? Our support team is always here to help.

Open an account with Eurotrader today!